The public consternation over Cambridge Analytica's "misuse" of Facebook users' data has received a lot…

The End of Taxation?

Governments tax to gather revenue to provide services for the public. These services are essential and need to be supported and funded. The question going forward is: how do we continue to fund education, healthcare, infrastructure, defence and security, policing, civil justice and other services that we must have to continue as a functional society?

The Taxation of Labor

Currently, the vast majority of tax dollars are provided through the taxation of labor. We tax the labor of working people through payroll deductions to fund government. Why is this a failing system?

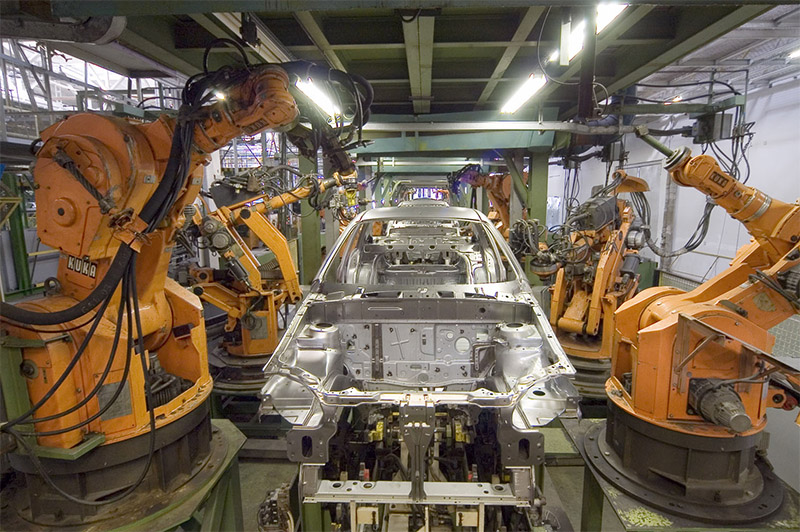

The taxation of labor is now a continuously diminishing source of government revenue. There are a number of reasons for this, but the biggest factor in all of this, is that we no longer need 100% employment to provide all the goods and services for society, because of the increasing automation of production systems (manufacturing etc.). Additionally, the labor providing goods and services may not be within the particular tax jurisdiction (i.e. out of the country). As unemployment rises and wages decline, government revenues (taxation) must decline as well. That is an inevitable consequence of an eroding tax-base. We may find ourselves in a future, in which, we need only 20-30% employment to provide all the goods and services for a society. What happens to the 70% who are unemployed?

What is the answer? If fewer jobs are available, it implies both higher (and chronic) unemployment and insufficient government services to provide for the needs of society. If we imagine there is a solution, it must be based on something other than taxing labor and must include ways of using those tax dollars to provide services to people who may never be employed in the current sense of the word. That may be an uncomfortable truth, however if we aren’t making a plan for the future, it is unlikely we will have a future!

Tax Transactions?

So what can we tax? Here is an interesting example: Apple corporation, one of the most profitable companies on the planet, uses cheap labor in China to build its products and pays it corporate taxes in Ireland (head office is there), but makes much of it profit from the sale of its products in jurisdictions (US for example) in which it has relatively few employees and pays very little tax. What is wrong with that picture? Let me be clear, this is not an anti-corporate argument, it is an argument for taxation based on transactions rather than labor. Transactions then become the key source of government revenue. This used to be called “Sales Tax” but it really is much broader than that, and can be accomplished electronically for the most part, since most purchases of goods and services occur via electronic transfer. Hard currency transactions can still be taxed via the sales tax model.

If we imagine a transaction-based system of tax collection, the need for taxing labor disappears since it is an increasingly smaller pool anyway. However, we do have the additional dilemma of supporting a population that doesn’t work (in the sense of having a paying job). How do we do that? Furthermore, for the minority that do have jobs, how are they fairly compensated for their labor? Do they receive the same “pay” as everyone else? These are not easy question since most of us believe that work should be rewarded and those who don’t work are less deserving. However, when we look at an entire society in which full employment is an impossibility, how do we value labor?

Increasing Unemployment

For those of us, who lean towards capitalism and the economic theories that support it, this looks like an impossible situation. Paying people who do not work? How can that happen? Inevitably this means what used to be called “The Welfare State” must provide for all of its citizens, even those who don’t work for a living. This implies free education and free healthcare at the very least, but what about food, clothing and shelter? We may find ourselves in an odd circular argument: if the government is dependent on financial transactions and a large part of society is dependent on free services (no transaction) do we end up with a bankrupt government? Somehow there must be a balance between collected taxes (revenue) and the services that are provided (expenses). The only way this can happen is if those who aren’t employed have a guaranteed income that they can spend which will generate transactions. The question then is, why does anyone work? Furthermore, how much do those who don’t work get paid and how?

Corporate Taxation

What about corporations? Do you we tax them? If we don’t tax labor, it makes no sense to tax corporate profits either, since “profits” can be payed out as wages and avoid tax. The only exception to this may be profits from publicly listed corporations that are paid out to shareholders as dividends. However, does it make sense to tax dividends like income, or should it just be another transaction?

While all of these questions, may challenge us going forward, there is little doubt that we cannot continue to do the same old, same old. How do we solve this?

Possible solutions

- Continue to tax labor, but have a guaranteed minimum wage and a much shorter work week (20 hours?) to ensure near full employment.

- Remove all personal and corporate taxes, tax only transactions and implement a revenue-sharing welfare state.

- Have a blend of the two solutions above by greatly reducing personal and corporate taxes, shortening the workweek, and implement more transaction taxes.

- Your idea goes here….

The time to think about this is now. We won’t be able to sustain developed economies going forward without profound changes in how we see work, and how we implement taxation.